All About Stonewell Bookkeeping

Things about Stonewell Bookkeeping

Table of ContentsThe Facts About Stonewell Bookkeeping UncoveredThe 45-Second Trick For Stonewell BookkeepingStonewell Bookkeeping Fundamentals ExplainedThe Main Principles Of Stonewell Bookkeeping Some Ideas on Stonewell Bookkeeping You Need To Know

Rather than experiencing a declaring closet of different records, billings, and receipts, you can present comprehensive documents to your accountant. In turn, you and your accountant can save time. As an included bonus offer, you might also be able to identify possible tax write-offs. After using your audit to submit your taxes, the internal revenue service may pick to do an audit.

That funding can can be found in the type of proprietor's equity, gives, organization loans, and investors. Financiers need to have a good concept of your company prior to spending. If you don't have audit documents, investors can not determine the success or failing of your firm. They require updated, exact details. And, that details needs to be easily easily accessible.

The Definitive Guide to Stonewell Bookkeeping

This is not meant as lawful suggestions; for more info, please go here..

We answered, "well, in order to know how much you need to be paying, we require to understand exactly how much you're making. What is your internet revenue? "Well, I have $179,000 in my account, so I think my internet revenue (incomes much less costs) is $18K".

7 Simple Techniques For Stonewell Bookkeeping

While maybe that they have $18K in the account (and also that might not hold true), your balance in great site the bank does not necessarily identify your earnings. If a person received a grant or a funding, those funds are ruled out income. And they would certainly not infiltrate your revenue statement in determining your earnings.

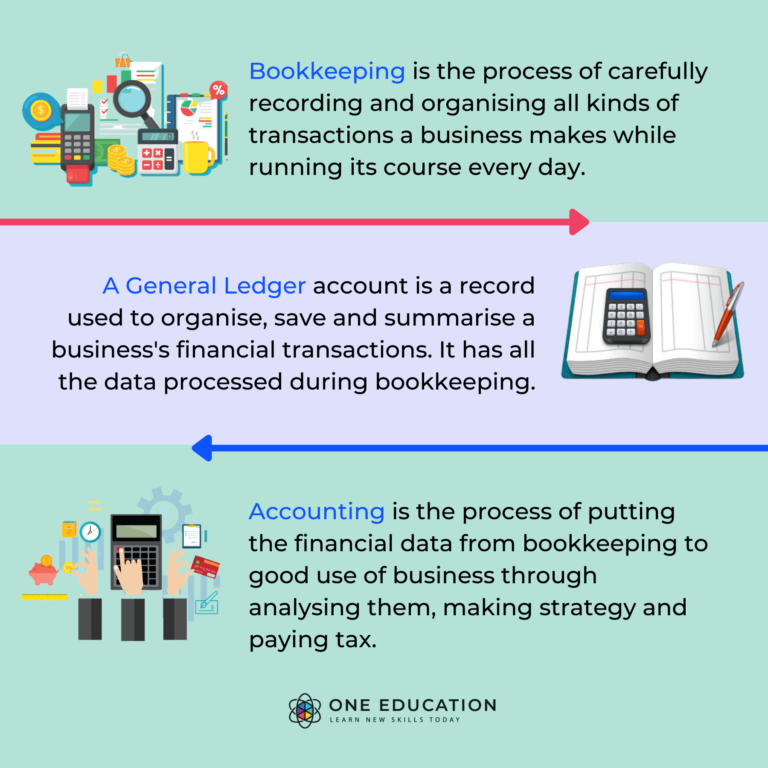

Several things that you believe are costs and deductions are in fact neither. A correct set of books, and an outsourced accountant that can appropriately identify those deals, will aid you determine what your company is actually making. Bookkeeping is the procedure of recording, classifying, and organizing a business's monetary transactions and tax obligation filings.

An effective organization requires assistance from specialists. With practical goals and an experienced bookkeeper, you can easily deal with difficulties and maintain those fears at bay. We devote our power to ensuring you have a solid monetary structure for development.

Stonewell Bookkeeping Fundamentals Explained

Precise bookkeeping is the foundation of great financial administration in any organization. With great bookkeeping, services can make better choices since clear economic records supply useful information that can assist strategy and boost profits.

Exact economic statements build depend on with lending institutions and investors, enhancing your possibilities of obtaining the resources you require to expand., businesses ought to on a regular basis integrate their accounts.

An accountant will certainly go across financial institution declarations with interior records at least once a month to locate blunders or incongruities. Called financial institution settlement, this process guarantees that the financial documents of the firm suit those of the bank.

They keep track of existing payroll data, subtract tax obligations, and number pay scales. Bookkeepers create standard monetary reports, consisting of: Earnings and Loss Statements Shows revenue, expenditures, and web revenue. Balance Sheets Details properties, obligations, and equity. Cash Circulation Declarations Tracks cash movement in and out of business (https://stonewell-bookkeeping.mailchimpsites.com/). These records help local business owner recognize their economic position and make informed decisions.

Stonewell Bookkeeping - Questions

The most effective choice depends on your spending plan and organization requirements. Some small company proprietors favor to manage bookkeeping themselves using software program. While this is cost-efficient, it can be lengthy and prone to mistakes. Tools like copyright, Xero, and FreshBooks allow entrepreneur to automate bookkeeping jobs. These programs assist with invoicing, bank settlement, and monetary coverage.